pa inheritance tax exemption amount

In order to determine the amount due under the PA Inheritance Tax a Personal Representative must ascertain the value of the decedents assets as of the date of death. Late returns are subject to penalties and interest.

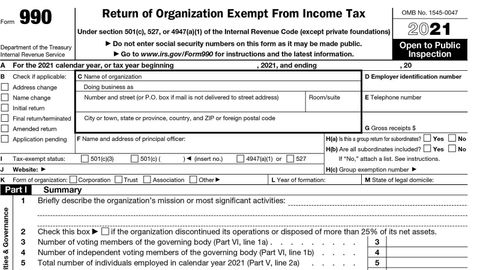

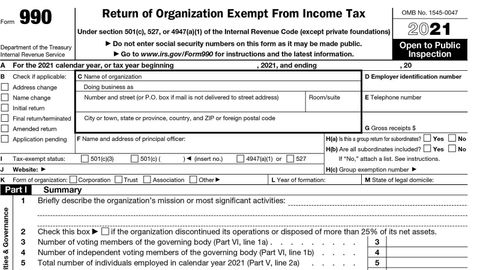

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

A dealers Pennsylvania Sales Tax exemption certificate is a valid form of notification to you from a dealer.

. This means that with the right legal maneuvering a married couple can protect up to 2236 million after both spouses have died. If an estimated tax payment is made within three months of death a five percent 5 discount on the tax due will apply. The federal estate tax exemption is 1170 million in 2021 and 1206 million in 2022.

This means as a couple you are paying Income Tax on 7430. There is still a federal estate tax. If an estate exceeds that amount the top tax rate is 40.

This exemption is portable. For each transaction provide a receipt with the amount of sweetened beverages supplied in the transaction and the amount of tax imposed on that transaction. Your partners income is 20000 and their Personal Allowance is 12570 so they pay tax on 7430 their taxable income.

This can appear in an invoice or a supplemental form provided by the City.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

New Inheritance Tax Exemption For Family Businesses In Pennsylvania Inheritance Tax Estate Administration Business Tax

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Pennsylvania Sales Tax Small Business Guide Truic

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

10 Ways To Be Tax Exempt Howstuffworks

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Requirements For Tax Exemption Tax Exempt Organizations

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Inheritance Tax Exemptions And Allowances Willpack

How To Get A Certificate Of Tax Exemption In The Philippines Filipiknow

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

International Estate And Income Tax Planning Strategies Tax Preparation Accounting Jobs Finance Jobs

What Is A Homestead Exemption And How Does It Work Lendingtree

New Inheritance Tax Exemption For Family Businesses In Pennsylvania Inheritance Tax Estate Administration Business Tax

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel